Life Insurance

Life Insurance

Life insurance helps to ensure that in the event of the unexpected, your family will be financially taken care of. In the case of a death, life insurance can provide the necessary funds to cover funeral expenses and other debts that may arise. It can also provide a sense of security and financial stability for the future. Take a look at the life insurance options below to see which one best suits your coverage needs!

Final Expense

Final expense insurance is an option for those who do not qualify for other life insurances as they typically have lower death benefits than traditional life insurance policies where premiums are often more affordable. This coverage is designed to cover the costs associated with a person’s funeral and other end-of-life expenses. Final expense insurance can provide peace of mind for those who want to help ensure his or her family from financial burdens that may arise from his or her passing on.

I love Bunch Insurance Group because their leaders are progressive, and they always want to satisfy my needs.

- Jose Diaz

Term Life

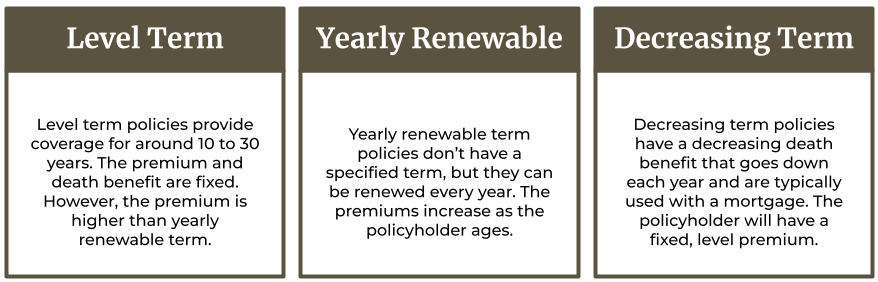

Term life insurance is a type of life insurance policy that provides coverage for a set period of time. It can be appropriate for those looking for insurance coverage for a specific period of time such as 10, 15, 20, or 30 years. It is typically a more affordable life insurance policy than permanent coverage, which is more expensive, and provides protection for your loved ones if you pass away during the specific coverage term of the policy. Some term insurance policies have premiums that stay level for the coverage term of the policy. In addition, some term policies can be renewed (however the premium will be higher at that time) or converted to a permanent policy when the term coverage ends. Policies differ, so be sure to ask if the policy you are considering features level term, renewals or conversions.

Whole Life

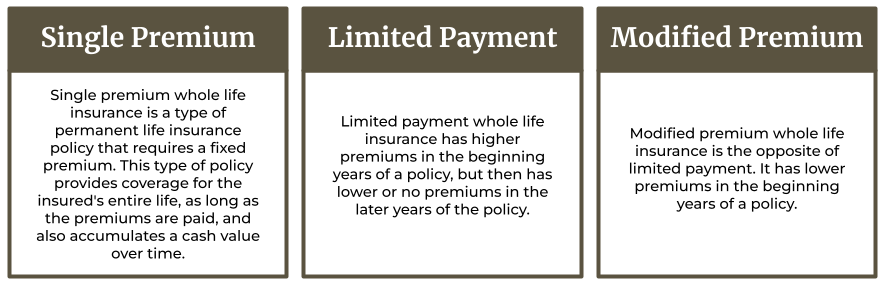

Whole life insurance is a permanent policy that provides coverage for the insured’s entire life. Whole life insurance also accumulates cash value*, which can be accessed by the policyholder during their lifetime and provides a death benefit to their beneficiaries upon their passing.

(*Access to cash value through borrowing or partial surrenders will reduce the policy’s cash value and death benefit, increase the chance the policy will lapse, and may result in a tax liability if the policy terminates before the death of insured).

A whole life insurance policy can give you peace of mind that you’ve helped to protect your family’s financial future if you were no longer in the picture.

Mortgage Protection Through a Life Insurance Policy

The proceeds of the death benefit of a life insurance policy can be used to help make mortgage payments in the event of the beneficiary’s death.